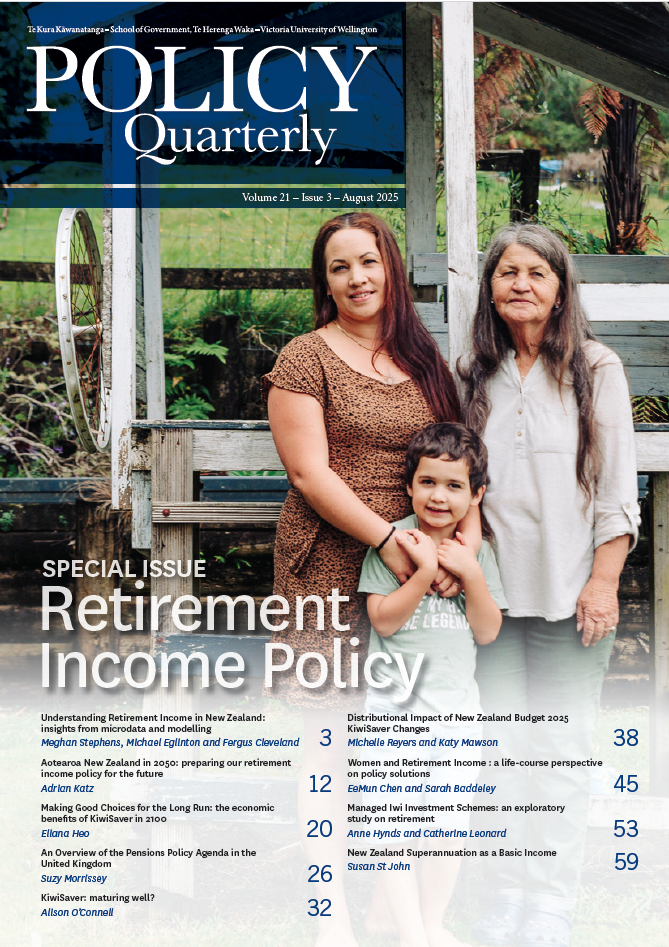

Managed iwi investment schemes: an exploratory study on retirement

DOI:

https://doi.org/10.26686/pq.v21i3.9940Keywords:

managed iwi investment, iwi-led investment schemes, savings, retirement, Māori, motivation, government policyAbstract

Managed iwi investment schemes and iwi savings schemes represent targeted financial initiatives established to enhance the economic security, autonomy and collective wellbeing of iwi members. These schemes are designed to address the unique needs of whänau (iwi-affiliated families), emphasising the need to save for significant life events such as tertiary education, home ownership and retirement. Despite their growing relevance, there remains a paucity of research concerning these schemes. In response, Te Ara Ahunga Ora Retirement Commission commissioned Ihi Research to conduct an exploratory study aimed at understanding the current landscape of iwi savings schemes. This article presents two case studies: the Ngāi Tahu Whai Rawa managed iwi investment scheme and the Ka Uruora WhänauSaver savings scheme. Key learnings emerged from the data that can inform the establishment and strengthening of future schemes. Successful schemes are grounded in iwi aspirations and development strategies, supporting financial wellbeing, tino rangatiratanga (self-determination) and cultural connection. Holistic support, including financial education and kanohi-ki-tekanohi (face-to-face) engagement, is essential to building confidence and trust among whānau. Early enrolment of tamariki (children) and a focus on intergenerational impacts are vital for creating long-term change. Flexibility in scheme design increases participation, although balancing immediate financial needs, such as housing, with long-term retirement savings remains a key tension. Managing partnerships with financial providers requires active stewardship to ensure iwi values are upheld, and government support for financial education remains a critical enabler.

Downloads

Downloads

Published

Issue

Section

License

Permission: In the interest of promoting debate and wider dissemination, the IGPS encourages use of all or part of the articles appearing in PQ, where there is no element of commercial gain. Appropriate acknowledgement of both author and source should be made in all cases. Please direct requests for permission to reprint articles from this publication to Policy-Quarterly@vuw.ac.nz.